Buying your first home? Don’t miss out on the benefits available to you

Buying your first home can be overwhelming and confusing. The purchase of your first home is an important decision and you risk missing out if you are uncertain about the financial benefits available to you. If you are a first home buyer, it’s important that you understand the grants and schemes available, when they need to be applied for, and who can make the application on your behalf.

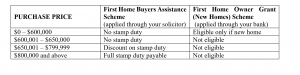

You may be eligible for two completely different benefit schemes when you purchase your first home and separate applications must be made in order to receive either or both.

First Home Buyers Assistance Scheme

The First Home Buyers Assistance scheme implemented by the NSW Government offers stamp duty benefits to first home buyers.

If you are an Australian citizen or an eligible Australian permanent resident, you will be exempt from paying stamp duty if the purchase price of your first home is $650,000 or less. If the purchase price of your first home is between $650,001 and $799,999, then stamp duty is payable at a discounted amount. You can calculate the amount of duty you need to pay using the Revenue NSW Transfer Duty Calculator.

The application to obtain this benefit is made in the early stages of your conveyancing transaction. At Indus Lawyers, we stamp in-house and the applicable exemption or discount is granted as soon as we submit the application to Revenue NSW.

First Home Owner Grant (New Homes) Scheme

The First Home Owner Grant (New Homes) scheme offers a $10,000.00 grant for Australian Citizens and eligible Australian permanent residents buying a new home for an amount not exceeding $600,000.

Your property is considered a new home if:

• the home has not been occupied previously as a place of residence and your transaction must be the first sale of the property; or

• the home has been extensively renovated or rebuilt as a replacement for a demolished property.

To be eligible to obtain the $10,000 grant, you must occupy the new home as your principal place of residence for a continuous period of at least 6 months, within the first year of owning the property.

It is ideal to lodge the application for this scheme through your bank in order to receive the grant at settlement.

Below is a useful summary of the benefits available to you as a first home buyer. Different rules apply if you are purchasing vacant land and you intend to build a home on the land.

If you want to learn more about the government benefits available to you, contact us for a friendly discussion today. We take care of your purchase so that buying your first home is as smooth and stress-free as possible.